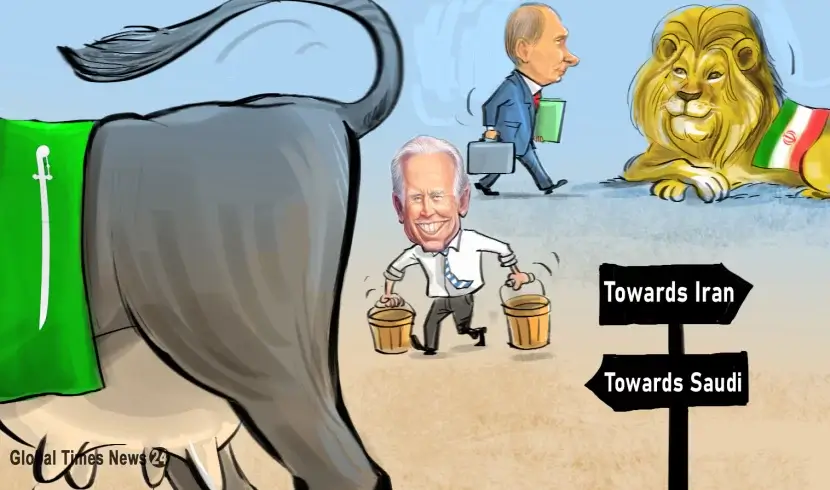

Saudi Arabia's role in the Biden administration is that of a cow, but there is nothing left for milking now

Saudi Arabia has the same role as that of a "milking cow" like that it had in previous American governments

Table of Contents (Show / Hide)

There is no doubt that in the Biden administration, Saudi Arabia has the same role as that of a "milking cow" like that it had in previous American governments, with the difference that there is no milk left for this cow to be milked by Biden.

President Joe Biden arrived in Saudi Arabia on a pre-planned visit.

According to "Jake Sullivan", the White House National Security Advisor, Biden's main goal of visiting Saudi Arabia and improving relations with Riyadh, as the largest oil producer of OPEC, is to increase the supply of oil in the world markets and lower the price of gasoline in the United States.

This is despite the fact that Saudi Arabia had repeatedly rejected the request of the United States to increase oil production with the aim of reducing its price in the world markets.

Actually, the Americans, by showing favor to the Saudis, want to encourage Riyadh to increase oil production and inject it into the world markets and improve the conditions of the oil market, especially at a time when there is not much time left for the congressional elections and the Democrats and their government are under the pressure of the public due to the doubling of gasoline prices in America.

Miscalculations that cost the term of the Biden administration

The biggest miscalculation of the Biden administration was the idea that heavy withdrawal of the country's oil reserves would reduce the price of oil and it would no longer need Saudi oil, but after a few months of implementing this strategy and withdrawing one million barrels of oil per day from the US oil reserves, not only did it not change the oil market, but it also made the price of black gold more expensive, to the extent that many experts have warned and emphasized the continuation of this strategy will increase the price of oil to $140.

The dream that Biden saw for the Saudi milk cow and the oil market

Now, in the next step and after the ineffectiveness of the withdrawal of strategic oil from America's reserves, despite Biden's election promises, including the trial of the perpetrators of the murder of "Jamal Khashoggi", a critical journalist of Saudi Arabia, in which "Mohammed bin Salman", the Saudi Crown Prince, is the first accused, oil has forced the Democrats to get closer to the Saudis, so both Democrats and Republicans look at Saudi Arabia as a milking cow, and in this trip, the President is trying to pressure Saudi Arabia to increase its oil production to 14 million barrels per day.

But the question that arises here is whether Biden's plan to get help from the old milk cow will help them achieve the goal of lowering the price of oil in the world market, or will this plan fail like the extraction of oil reserves?

According to Katharina Buchholz, senior data journalist at Statista, Saudi Arabia's crude oil production was a record-high 11.6 million b/d in April 2020. It was registered only in one month of this year.

This figure was also recorded during the war between Saudi Arabia and Russia over determining the price of oil and caused a heavy fall in the price of oil in the world markets. For this reason, the two countries quickly reached an agreement and Saudi Arabia reduced the oil production.

It is possible that at that time, instead of actually increasing oil production, Saudi Arabia used its reserves to increase supply and export, and did not really have the capacity to increase oil production, but even if we consider Saudi Arabia's production capacity of 12 million barrels per day in that short period and consider that the current production of this country is 11 million barrels per day, it can be said that Saudi Arabia only has the capacity to produce one million barrels more to be milked by the Americans.

When even the Saudi milk cow can't be a problem solver

Under normal conditions, this figure could have affected the oil market to some extent, but the current crisis in the oil market, following Russia's attack on Ukraine and the Russian oil embargo by the European Union and the United States, is not in a situation that the addition of one million barrels of Saudi oil to the market can change the market situation.

In the current situation, the oil market is putting increasing pressure on the price of oil in several ways: Firstly, after the successive drop in oil prices, like what we saw in 2014 onwards, and reached its peak in 2020, amidst the Corona epidemic, many oil producing countries, significantly reduced investment in upstream oil projects from exploration to extraction and production.

In the meantime, the will of Western countries, especially European ones, to move towards clean energy has not been ineffective in this matter and has led to the point where many Western automobile companies have announced that they want to reduce or completely stop the production of gasoline and diesel cars in a couple of years.

The drop in oil prices in 2020, along with anti-oil approaches by Western countries, led to a sharp decrease in investment in increasing production capacity by major oil producing countries.

The current demand for is not comparable to the normal situation in the years before the Corona outbreak. Today, the world is observing a sharp increase in demand, due to the subsidence of the Corona and increasing demand for energy carriers.

In addition to this, the crisis of the West's attempt to sanction Russia's oil and gas market should be taken into consideration, which has fueled the tension for oil supply in the world market.

According to JPMorgan Bank, the largest American bank, the Russians may decide to cut even up to 5 million barrels of oil exports to the world market without suffering much economic damage, and this has the potential to push oil prices up to $380 per barrel.

The best option to reduce the price

In such a situation, even if the pressure on the Saudis is fruitful and leads to a full increase of one million barrels of their maximum oil supply capacity to the world market, it cannot reduce the severity of the possible crisis of price spikes.

It seems that, instead of begging the Saudis, Biden has one better option to control the market relatively, and that is to lift the oil sanctions against Iran and Venezuela, as the two oil powers are members of OPEC.

If the sanctions against these two countries are lifted, several million barrels will be added to the oil market of the world market in a short period of time, and it can bear a significant part of the burden of increasing demand.

URL :

News ID : 1070

EU preparing emergency plan for energy crisis

EU preparing emergency plan for energy crisis

As cryptos rebound from major sell-off, Bitcoin climbs above $18K

As cryptos rebound from major sell-off, Bitcoin climbs above $18K

First Republic Bank drops 70% amid Silicon Valley Bank collapse

First Republic Bank drops 70% amid Silicon Valley Bank collapse

Ethiopia Proposes Innovative Solutions to Maritime Challenges

Ethiopia Proposes Innovative Solutions to Maritime Challenges

Tomato crisis in California as drought intensifies

Tomato crisis in California as drought intensifies

Americans acknowledge Biden's failure to solve the fuel crisis during his trip to Saudi Arabia

Americans acknowledge Biden's failure to solve the fuel crisis during his trip to Saudi Arabia

NOPEC; US attempt to realize the long-held dream of a "new Middle East"

NOPEC; US attempt to realize the long-held dream of a "new Middle East"

Kiss of Ashgabat

Kiss of Ashgabat

Despite Biden's vows, Yemen starves

Despite Biden's vows, Yemen starves

Increase in the cost of Hajj up to 300% in 2022

Increase in the cost of Hajj up to 300% in 2022