Fitch Ratings reported on Friday that the prospects for most sectors in North America are diminishing due to a slowdown in economic growth, increased unemployment, and stringent financial conditions.

"While U.S. growth exceeded expectations at 2.4% in 2023, we anticipate a decline to 1.2% in 2024, with a modest recovery projected for 2025," stated the report. "Despite a gradual easing, core inflation persists above central banks' 2% targets."

The rating agency identified key risks such as prolonged elevated interest rates, financial market fluctuations, constrained funding conditions, decelerating economic growth, and challenges to pivotal asset classes like real estate and structured finance.

"Profits are diminishing across various sectors, with an anticipated further deceleration in demand as the economy adjusts to the delayed impact of heightened interest rates and tightening credit conditions," noted the report.

It highlighted that escalating unemployment and the increased cost of living pose significant challenges for consumer-oriented industries and asset classes, putting additional pressure on the asset quality and operating profits of U.S. banks.

Fitch expressed a neutral outlook for Canadian banks, noting their adaptation to the heightened rate environment. Meanwhile, the life insurance sector in the U.S. shows signs of improvement as insurers continue to benefit from elevated interest rates.

News ID : 2709

Consider these for Opening a Company in Dubai

Consider these for Opening a Company in Dubai

Fed chair hints smaller rate hikes may start later this month

Fed chair hints smaller rate hikes may start later this month

Onions make the Philippines cry

Onions make the Philippines cry

Revenues of Suez Canal hit all-time high in April

Revenues of Suez Canal hit all-time high in April

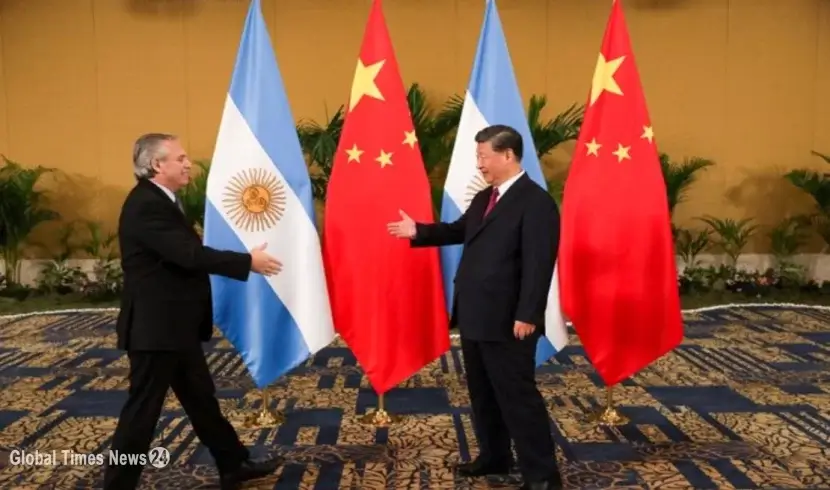

China and Argentina agree to currency swap at G20 summit

China and Argentina agree to currency swap at G20 summit

Israeli Housing Market Crisis: War Sparks Industry Collapse

Israeli Housing Market Crisis: War Sparks Industry Collapse

Operation Al-Aqsa Storm: Impact on Israeli Economy

Operation Al-Aqsa Storm: Impact on Israeli Economy

10 Reasons to Start business in Dubai

10 Reasons to Start business in Dubai

Major sports events of 2022

Major sports events of 2022

7 Trending AI Business Ideas for 2023

7 Trending AI Business Ideas for 2023