Vision 2030, the eye-watering $7 trillion-plus development plan for Saudi Arabia “has a huge positive impact on us, Saudis. Now we have something to be proud of, not just our oil. Now we have ambitions.”

That’s the celebratory assessment of Reham Alshammary, a Saudi private equity and venture capital expert. “For me, Neom [the plan’s centerpiece, a ‘city of the future’ to house nine million people] is more of a huge R&D hub. Research and investments done there will impact how we live across the globe.”

If it is indeed built – as Saudi Arabia claims it will be – Neom will be a collection of projects built on an area the size of Belgium to tackle, according to its own PR, “some of the most pressing challenges facing humanity” by “building a new model for sustainable living.” Sub-city Trojena will “redefine mountain tourism,” while Oxagon’s “factories of the future” will “redefine the world’s approach to industrial development,” and megacity The Line will stand as “a civilizational revolution.”

But five years in and with little progress in sight, cracks are appearing in Crown Prince Mohammed bin Salman’s flagship project to diversify the oil-driven Saudi economy.

Former Neom employees expressed concern that such a project might never be possible. Architectural experts have called it "insane". Sources inside the royal circle no longer shy away from criticizing Mohammed bin Salman's ever-changing ideas, mood swings, appalling behavior and fear-based leadership.

“The general concern is this will turn out like for the Shah of Iran, developing schemes that become incredibly detached from reality and no one will tell him to refocus,” a source familiar with the dynamics of Saudi Arabia’s royal family told me, on condition of anonymity. The last Shah of Iran, a tyrannical ruler with autocratic behaviors and Western-style leanings who pushed modernizing reforms, was overthrown in 1979 during Iran’s Islamic Revolution.

“I do not know how much credible information MBS is getting about how difficult Neom really is, because there is every incentive for people close to him to say what he wants to hear,” the source added, summarizing the risk of the Crown Prince ending up in an echo chamber cemented by yes-men. Power consolidation under MBS is unprecedented in Saudi Arabia’s recent history, moving the kingdom’s system from “one of consensus within the family to one-man rule.”

Whether Neom is economically sound or an ego-driven science-fiction jumble ("Black Mirror" with touches of "Blade Runner”) is an open question. One thing is sure. Leaks reveal insiders’ growing uneasiness, which points to the elephant-in-the-room question: Will MBS’ grandiose venture bankrupt the kingdom?

In July, the Crown Prince outlined how he expects to fund the futuristic megaproject. About half of the SAR 1.2 trillion ($320 billion) first phase of the project, scheduled to run until 2030, will be funded by the Public Investment Fund, an MBS-era $620 billion state-within-the-state financial vehicle to diversify the kingdom’s oil-driven economy. Government subsidies and other sovereign wealth funds in the region will fund the other half.

In other words, a large chunk of Saudi money carefully set aside for decades to fund the transition to a post-oil era will pay for Neom's astronomical price tag. A bet on an unproven vision. Make no mistake, Neom could yield Saudi Arabia long-term returns, but history suggests caution: Megaprojects often look economically good on paper, and certainly beguile the eye, but don’t deliver anything like their hype in real life.

Alshammary brushes aside criticism. “Everyone is super enthusiastic and excited” in Saudi Arabia, she says. But by leveraging the younger Saudi generation’s faith in the future, and highlighting MBS’ clear ownership of the project to foment socioeconomic revolution, the risk is a brutal hangover if Neom fails.

What is at stake? For Saudi Arabia, a potentially tremendous financial loss, the irretrievable loss of time spent on fantasies rather than tangible solutions for its post-oil future, and loss of trust in the regime, meaning the chance of political instability.

And that’s where MBS, high on his visionary self-branding and his concentration of power, may have to pay the costs of bankruptcy – whether by admitting full responsibility or via a renewed deployment of decidedly imperious and despotic tactics to crush dissent. The latter path is, of course, what the late Shah of Iran chose, with notorious results.

News ID : 1341

Russia Claims Control of Two Villages in Eastern Ukraine

Russia Claims Control of Two Villages in Eastern Ukraine

Putin: Western countries have “nothing to offer” other than “robbery and racketeering”

Putin: Western countries have “nothing to offer” other than “robbery and racketeering”

Robert Kennedy Warns of Zelenskyy’s Strategy to Escalate Conflict with Russia

Robert Kennedy Warns of Zelenskyy’s Strategy to Escalate Conflict with Russia

Despite cease-fire deal, clashes renew in Sudanese capital

Despite cease-fire deal, clashes renew in Sudanese capital

The Deadliest Job in America

The Deadliest Job in America

Fears of Bin Salman to reach the throne

Fears of Bin Salman to reach the throne

Increase in the cost of Hajj up to 300% in 2022

Increase in the cost of Hajj up to 300% in 2022

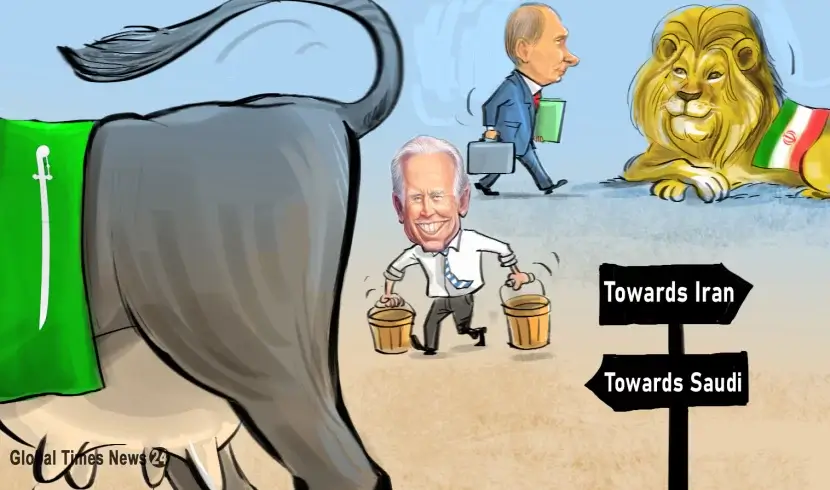

Saudi Arabia's role in the Biden administration is that of a cow, but there is nothing left for milking now

Saudi Arabia's role in the Biden administration is that of a cow, but there is nothing left for milking now

Islamic tourism against Saudi terrorism, two gifts of two different kinds

Islamic tourism against Saudi terrorism, two gifts of two different kinds

Saudi Arabia’s soft infiltration in world film festivals including Cannes Film Festival

Saudi Arabia’s soft infiltration in world film festivals including Cannes Film Festival